Have you adequately assessed your Plan’s risks?

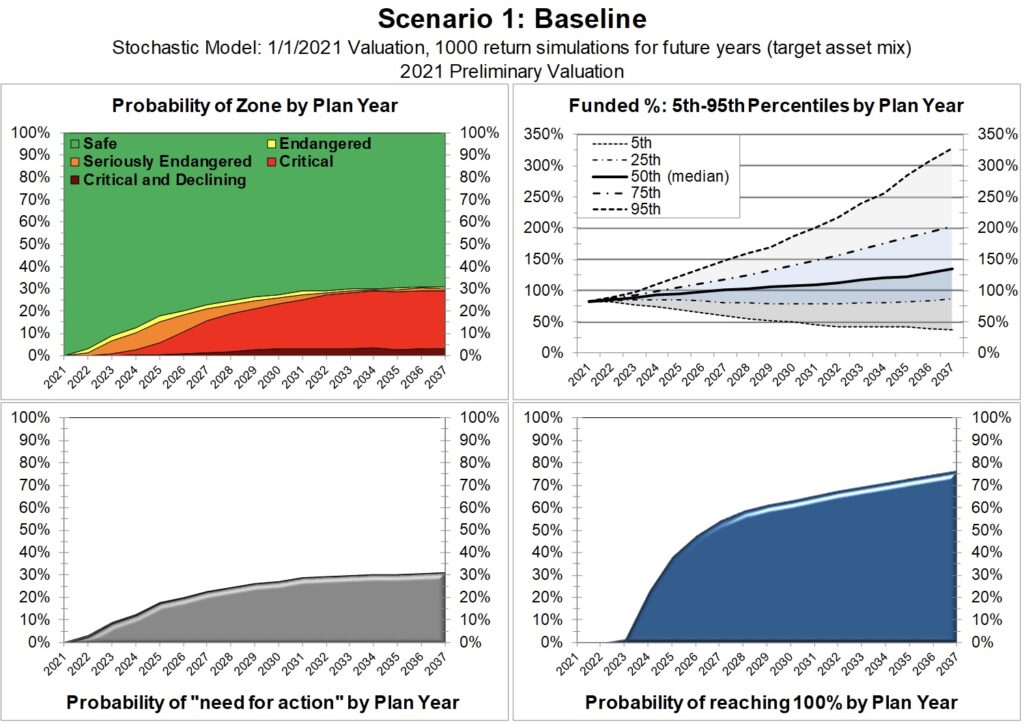

What is a dangerous funded status for your Plan given your Plan’s maturity and recovery tools? Completing a risk assessment may help you proactively address a problem before it is too late.

Multiemployer Defined Benefit (“DB”) plan solvency risk has significantly increased in the last 20 years with the substantial decline in union membership, technology advances, and investment market underperformance. While your plan may not be one facing Insolvency, your actuary’s statistics likely reflect a plan that is far more mature than 20 years ago. As a result, corrective actions to future benefits for actives and employer contribution increases will vary in their effectiveness in assisting an underfunded plan. Does your Board understand the tools that remain and their effects in correcting any funding shortfall? Is there a funding target that would be best for your plan to achieve in safeguarding its long-term sustainability? Are your plan’s investments appropriate given your plan’s funded position, recovery tools and maturity? If you do not know the answers to these questions, then a risk study may be appropriate.

Stochastic Modeling – Is it right for your Plan? Stochastic modeling is powerful tool to better evaluate a plan’s funding risks and help Trustees make policy decisions.

Have you considered a Variable Defined Benefit (“DB”)?

Let’s discuss how a Variable DB might improve your Plan’s overall health and reduce withdrawal liability risk over time.

Because traditional DB designs are required to protect the dollar value of benefits earned, asset and liability mismatch occurs when investment returns lag assumed return rates. When assets are less than vested liabilities in multiemployer pension plans, employers are subject to continuing contributions to make up their share of this funding shortfall in the form of withdrawal liability should they withdraw. This contingent liability has hampered organizing of new employers to traditional multiemployer DB plans. By design, a Variable DB (see video below)

virtually eliminates asset and liability mismatch by adjusting benefit accruals earned under the Variable plan to actual investment returns. A Variable DB design can also address purchasing power loss over time through the pension formula design and benefit adjustment features.

While transitioning to a Variable DB plan design will not solve any legacy traditional DB funding challenges, it can be an attractive solution to mitigate risk over time and ultimately deliver benefits that are better protected from inflation. As a new plan, Variable DB stays well funded in all market settings, which virtually eliminates withdrawal liability risk making the design an attractive alternative to employers pondering the best way to deliver employer-provided benefits for the lifetimes of their employees. Have you analyzed if Variable DB might be a better choice for your participants?

Do you have a plan for addressing benefit adequacy for future retirees?

Purchasing power has significantly declined given DB Plan benefit rates and the rising cost of retiree medical. Are there steps you can take to provide for a more secure future for your participants?

As market returns have lagged expectations in traditional multiemployer DB plans, future benefit accruals have been flat or reduced. At the same time, medical cost inflation has made the cost of securing post-retirement medical coverage challenging. As a result, the ability to retire at early retirement ages has significantly eroded over the last 10 or more years for many participants. Forecasting the adequacy of retirement income sources in the future paints an even bleaker picture for those planning to retire before government sources kick in. Do you know where your plan stands in its ability for members to retire? If the inability to retire early concerns your Trustees, perhaps you can do something about it by providing more resources to participants to help them manage their retirement plans.

Do you allow participant contributions into your Defined Contribution (“DC”) Plan?

Adding a 401k feature to your DC plan can allow participants more retirement financial flexibility and less worry. Does adding this feature now make sense for your plan given DB plan benefit levels?

With employers limited in their ability to further assist underfunded traditional DB plans, some have turned to their DC plans to allow employees to supplement their retirement sources. In the multiemployer arena, 401(k) pre-tax deferral features have been increasingly used to allow participants to supplement stagnant employer provided DB and DC plan benefits. These member contributions may be enough to bridge the retirement income gap for members wishing to retire before Social Security and Medicare commence. Have you looked at your DC design to see if there are better ways to enhance retirement flexibility?

Is your Public Plan’s funding level a concern?

Talk to us about funding strategies and policies that could work for your Plan.

Public plans have had an increasingly keen eye on improving their funding levels to ensure long-term benefit adequacy for their members. While public plans typically adopt contribution policies that have a long-term goal of achieving 100% funding, an increasing number of plans have taken a more aggressive approach to funding their pension plans faster in light of economic conditions and demographic expansion. With short-term market return expectations somewhat tempered and an increasing number of baby boomer retirements, plans have been updating their funding policies to address anticipated market and demographic changes. Have you reviewed your funding policy to see if a policy change is warranted? We can help with strategies and goals to achieving 100% funding within your target period.

Have your Public Plan’s actuarial assumptions and funding valuation results been reviewed for reasonableness?

We can provide audit valuation services and review your plan’s actuarial assumptions to ensure they are consistent with industry standards.

What are your top retirement plan issues?

Looking to run it by someone? What are you and your co-workers, fellow Trustees and plan professionals seeing, doing, or concerned about? Contact Bruce Cable at [email protected] if you would like some help.

We understand your plans.®

Rael & Letson consultants have been active with various projects focusing on Retirement topics. Below are three examples:

1. Variable Defined Benefit (“DB”) Plan Start-up

2. Growing the Active Population

3. Public Plan Valuation Audit

- Variable Defined Benefit (“DB”) Plan Start-up—Rael & Letson has collaborated with a local multiemployer construction industry group to establish a new variable defined benefit pension plan that is expected to be sustainable for the long term. Using new funding sources, this plan will supplement the existing retirement benefits and improve lifetime benefit adequacy for members while providing greater control over benefit delivery.

Outcome: Significantly improved employer provided benefit delivery for career union members by establishing an inflation-protected source of lifetime retirement income.

For more information about a Variable Defined Benefit, Please watch this video

- Growing the Active Population—Rael & Letson worked closely with a Board of Trustees to implement a Variable DB design for future benefit accruals and obtain PBGC approval for a two-pool withdrawal liability method that will significantly reduce funding risk for prospective employers to an established, well-funded but mature, non-construction multiemployer pension plan.

Outcome: Two new employers joined the plan increasing the contributions by about 40% and reducing ongoing plan funding risk for all participating employers.

- Public Plan— Rael & Letson provided audit valuation services for a public entity including a comprehensive review of the plan’s mortality basis for determining monthly benefits under optional payment forms (i.e., Joint & Survivor pensions). By updating the mortality table used for calculations of Joint & Survivor benefits, the plan’s assumption will align with current industry standards, longer life expectancies and plan-specific experience.

Outcome: The plan is in the process of updating the mortality basis used for calculations of Joint & Survivor pensions to reflect current mortality patterns resulting in higher monthly benefits to married participants.

Senior Consultant Wesley Yoder discusses the rules and challenges that plan sponsors face when introducing and managing existing retiree health and welfare plans.Click here for the article featured in Benefits Magazine.(PDF)