Cell and Gene Therapy (CGT): What plan sponsors need to know

What is Cell and Gene Therapy?

Cell and Gene Therapy (CGT) are new classes of medical treatments that alter part of a patient’s DNA/genes through the replacement, deletion, or insertion of genetic material to treat a disease. The goal of both treatments is to change DNA/genes so the body can build proteins to change or stop the disease.

Gene therapies target rare genetic and inherited conditions like blood cancers, retinal dystrophy, and Spinal Muscular Atrophy, while cell therapies predominantly target cancer.

Because these treatments are so promising, there has been a recent wave of FDA approvals:

| Prior to 2017 | 0 approved |

|---|---|

| 2017-2019 | 3 approved |

| 2019-2024 | 23 approved (13 gene and 10 cell) |

Why are CGTs so Expensive?

These therapies are very expensive, with some individual CGT therapies now cresting above $3 million dollars each. Based on the approval pipeline, annual spending could increase from $5.15 billion in 2020 to $25.3 billion in 2026, and private/commercial payers are expected to pick up half of this amount.

Many CGT therapies are priced so highly because the manufacturers claim the treatments are ‘curative.’ Because of this, they are asking payors to pay up-front for costs that they would have otherwise incurred over a much longer period of time.

While the transformational potential of many CGT therapies is evident, there is growing concern about the durability of their benefits over the long term and the short-term financial shock of high prices. Until the long-term data comes in, it is better to think of benefits as ‘near-durable’.

What is the Risk to Plan Sponsors and Payers?

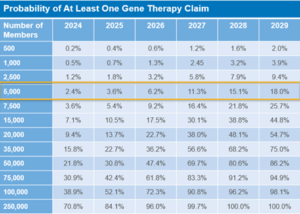

As shown in the chart below, there is a potential risk for every payer and the likelihood of claimant will dramatically increase with population size and the wave of FDA approvals.

Considerations for Plan Sponsors

Plan sponsors should evaluate coverages to determine if CGTs are included or excluded (Rule of Thumb: if a benefit is not explicitly excluded, it should be considered included). They should also evaluate whether stop-loss coverage covers CGT, and whether those CGT claims can be lasered and/or excluded in the next stop-loss renewal. There may also be state mandates to cover CGT in fully insured plans.

Contact us to discuss the different types of solutions that might be right for your plan and participants.

You must be logged in to post a comment.