Is Stochastic modeling right for your Plan?

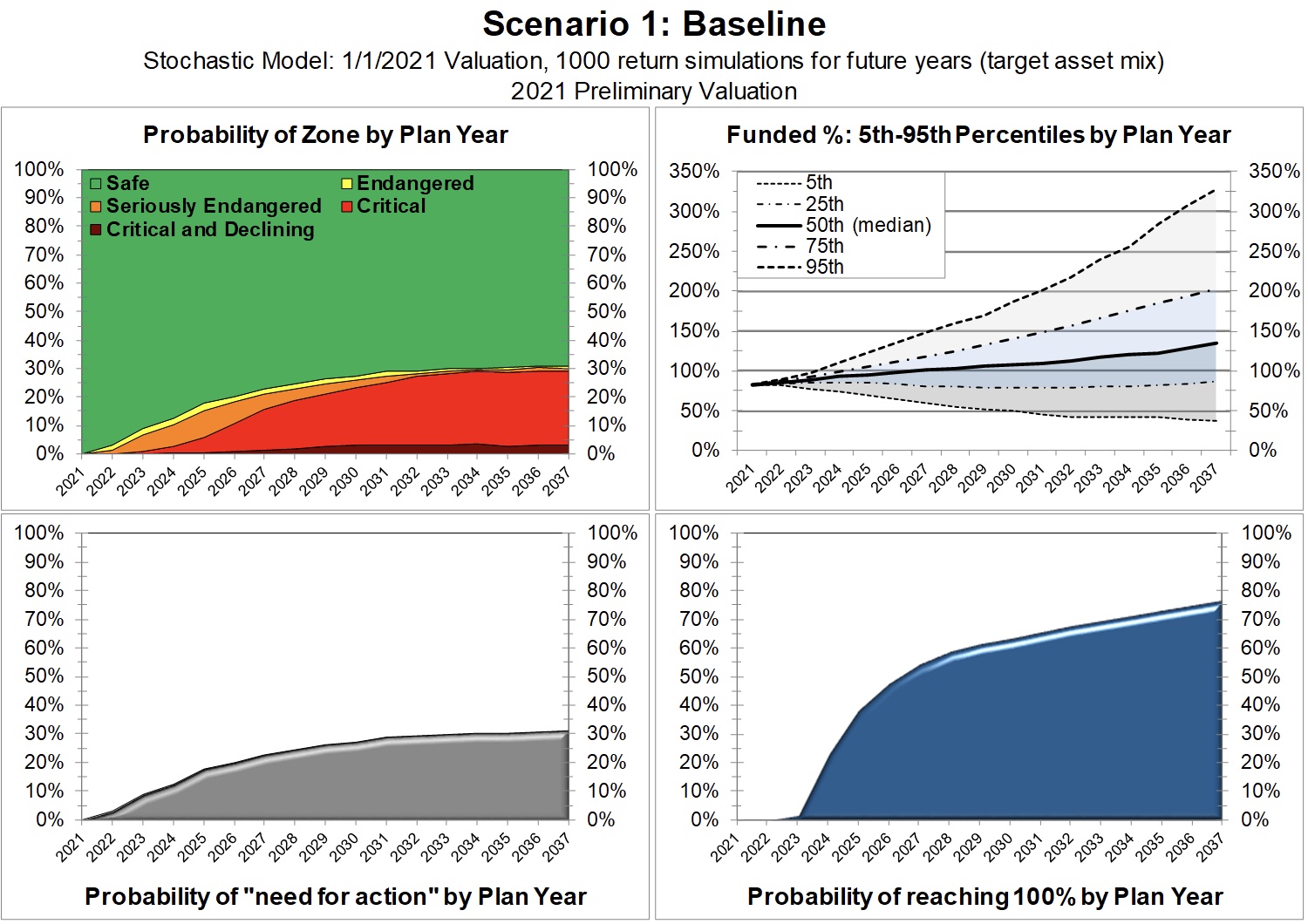

Stochastic modeling improves upon the traditional projection model by forecasting key pension plan financial measures using many different economic simulations to produce a comprehensive range of possible pension outcomes. In a single picture, stochastic modeling shows a range of possible outcomes and assigns probabilities to those outcomes over the projection period.

Using Rael & Letson’s proprietary stochastic modeling tool (example above), outcomes reflect the differing expectations for investment returns over the first 10 years, years 11-20 and years after 20. Multiple scenarios can be modeled using different contribution levels and benefit alternatives.

Would scholastic modeling benefit your plan?

Contact a Rael & Letson consultant to learn more about stochastic modeling and what it can do for your plan.